Countdown to Dencun: Examining ETH's Historical Relative Performance Amidst Significant Upgrades

Technical developments in crypto usually don’t impact price action meaningfully, at least in the short term. Ethereum upgrades, however, tend to be an exception.

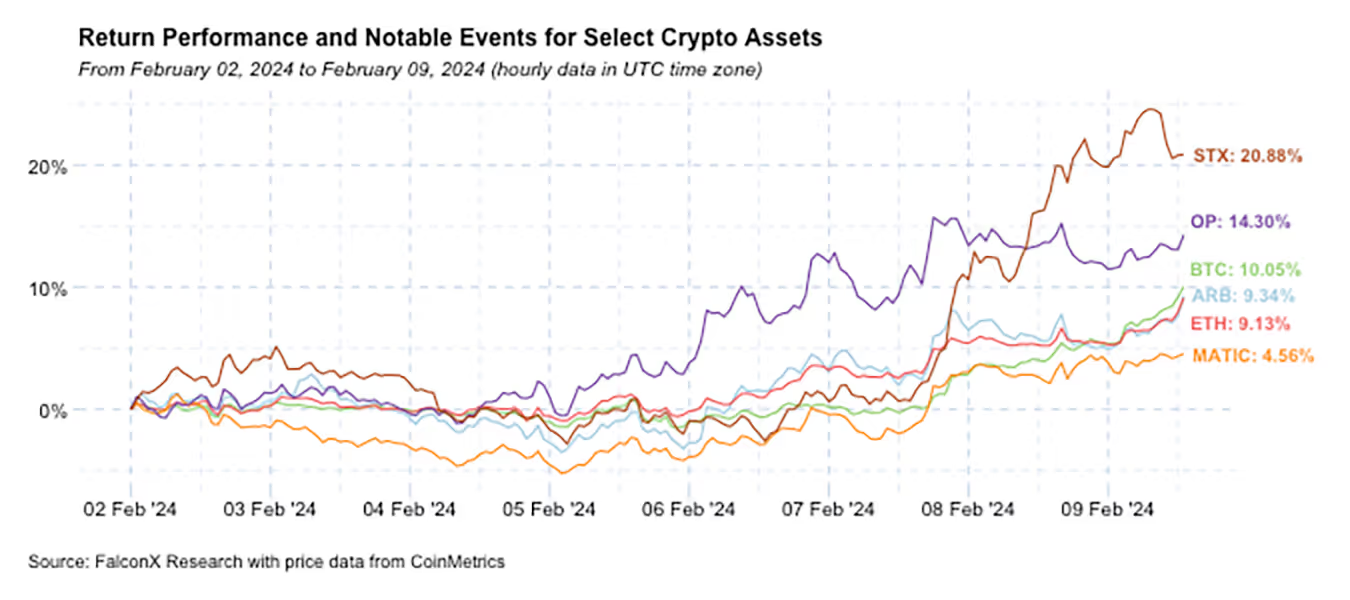

Over the past seven days, the total crypto market capitalization grew by 3.98% (4.27% excluding stablecoins) and currently sits at $1.68 trillion ($1.54 trillion excluding stablecoins).

ETF net inflows continued to accelerate and came in at over $400 million yesterday, which is nothing short of formidable almost a full month into the launch. Overall risk assets also continue to rip higher. I continue to pay attention to the correlation between crypto and overall risk assets, as the BTC/SPy correlation is now at 0.23 (versus -0.23 at the end of 2023).

Overall, this was a good week for BTC on a relative basis: The leading crypto asset not only slightly outperformed ETH over the past week, but STX also outperformed by a wide margin ETH’s main L2 projects, such as OP, ARB, and MATIC.

The relative performance battle between BTC and ETH is about to get spicier, though. Although BTC has a lot going for it, as ETF inflows are coming strong and halving is approaching, the next major Ethereum upgrade is now set to activate in a little over a month.

After three successful dress rehearsals in the Sepolia, Goerli, and Holesky testnets, Ethereum developers set the target date of Dencun, the next major upgrade, to March 13. The main new feature brought by Dencun is the introduction of a more efficient way to store temporary data on the Ethereum blockchain, which can significantly reduce the cost of L2s to post data on the L1.

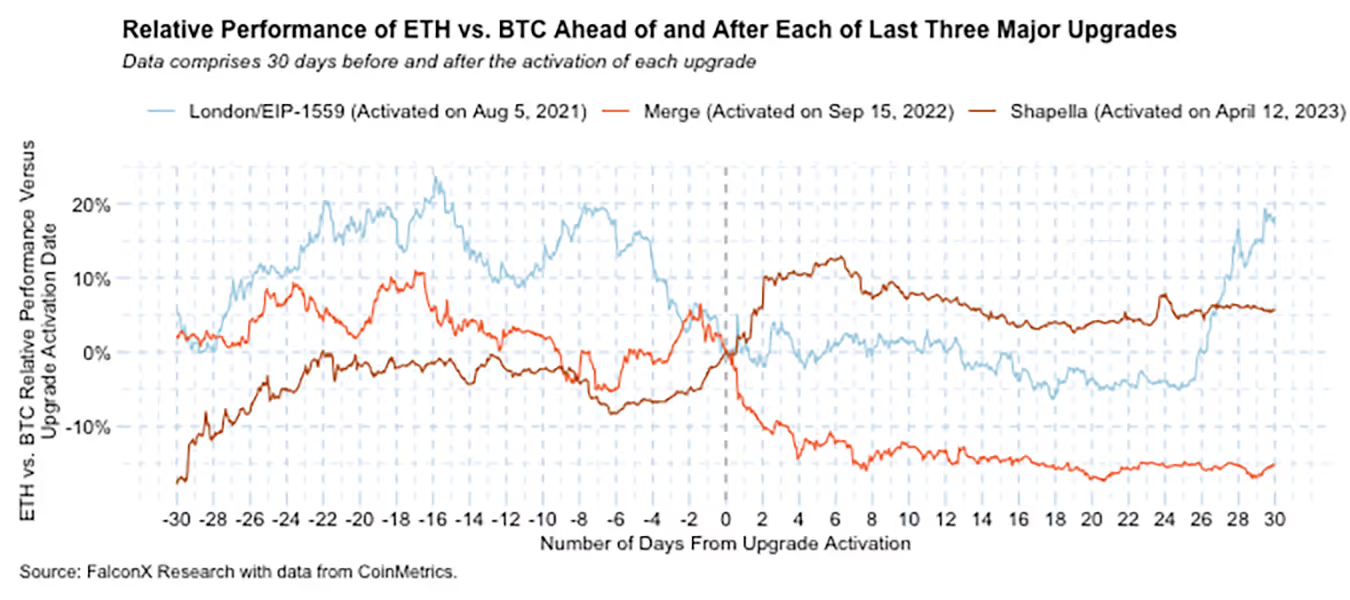

Technical developments in crypto usually don’t impact price action meaningfully, at least in the short term. Ethereum upgrades, however, tend to be an exception.

The following chart shows the cumulative relative performance of ETH versus BTC in the 30 days before and after the past three major upgrades: Shapella, which introduced the ability to withdraw staked ETH on April 12, 2023, The Merge, which moved Ethereum from proof of work to proof of stake on September 15, 2023, and London, which changed the economic logic of ETH through the introduction of EIP-1559 on August 05, 2021.

One general trend is that ETH tends to outperform BTC ahead of upgrades (ie, the lines to the left of the middle reference date are mostly above zero), with the bulk of the outperformance taking place either 2-3 weeks ahead of the upgrade or on the days leading up to it. The exception was the Shapella upgrade. This is likely because the month leading to this upgrade included the pinnacle of the U.S. mid-sized banking crisis in March 2023, which proved to be a major tailwind for BTC.

The performance after the upgrades, however, does not show a clear trend. While ETH outperformed BTC consistently in the 30 days after Shapella and at the very end of the same period after London/EIP-1559, it consistently underperformed following the Merge.

Following a dismal 2023 performance, The ETH/BTC price ratio brushed the 0.05 level, the lowest since Q2 2021, before bouncing back to 0.06 and partially retrenching more recently. Since November 2023, when broader macro drivers started to take the driver’s seat of crypto price action, ETH has slightly outperformed BTC. The next few weeks leading into the Dencun upgrade might be an initial test of how much strength ETH has to catch up.

Other Top Trends We're Watching

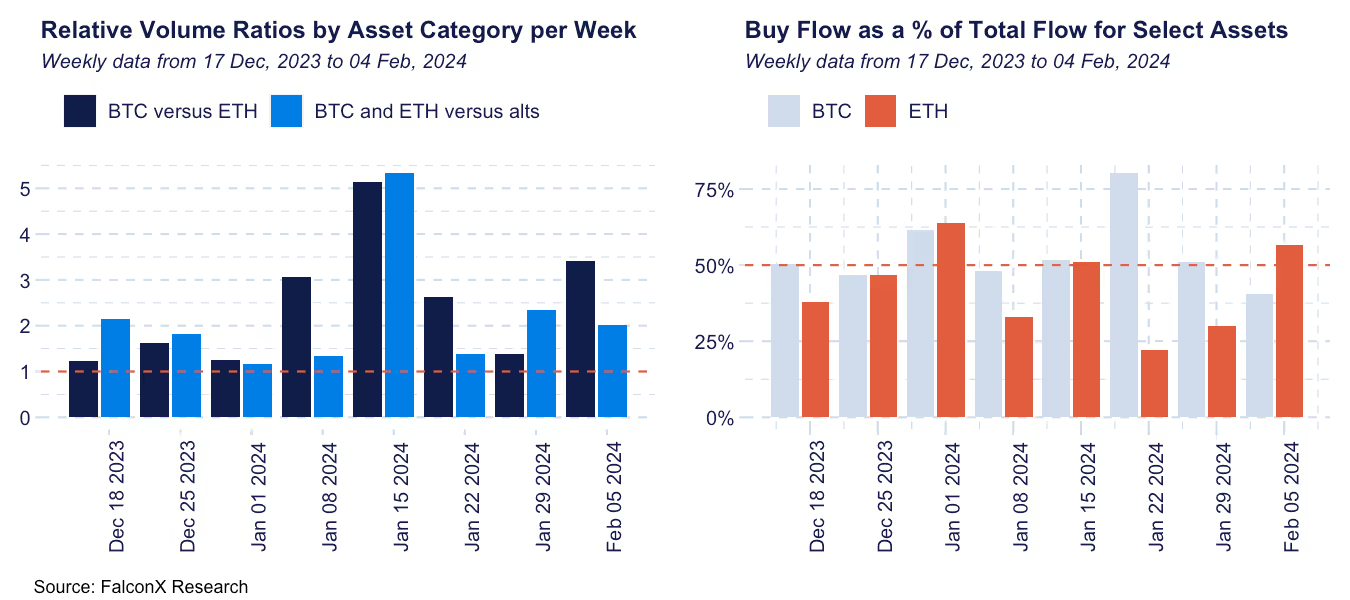

FalconX Trading Desk Color: Similarly to the past few weeks, our desk saw flows across different client personas in mixed directions. Hedge funds and prop desks were slightly better sellers (53% and 54% of total flow), while retail aggregators were heavy buyers (71% of total flow). BTC continues to dominate desk activity, trading 3.42x more than ETH, the highest ratio over the past four months, except for the week in which the spot BTC ETF was launched. Buy interest in ETH was notably stronger over the past few weeks, driven mostly by retail aggregators. Among alts, we saw buy flows in SOL and LINK and sell flows in NEAR and ARB.

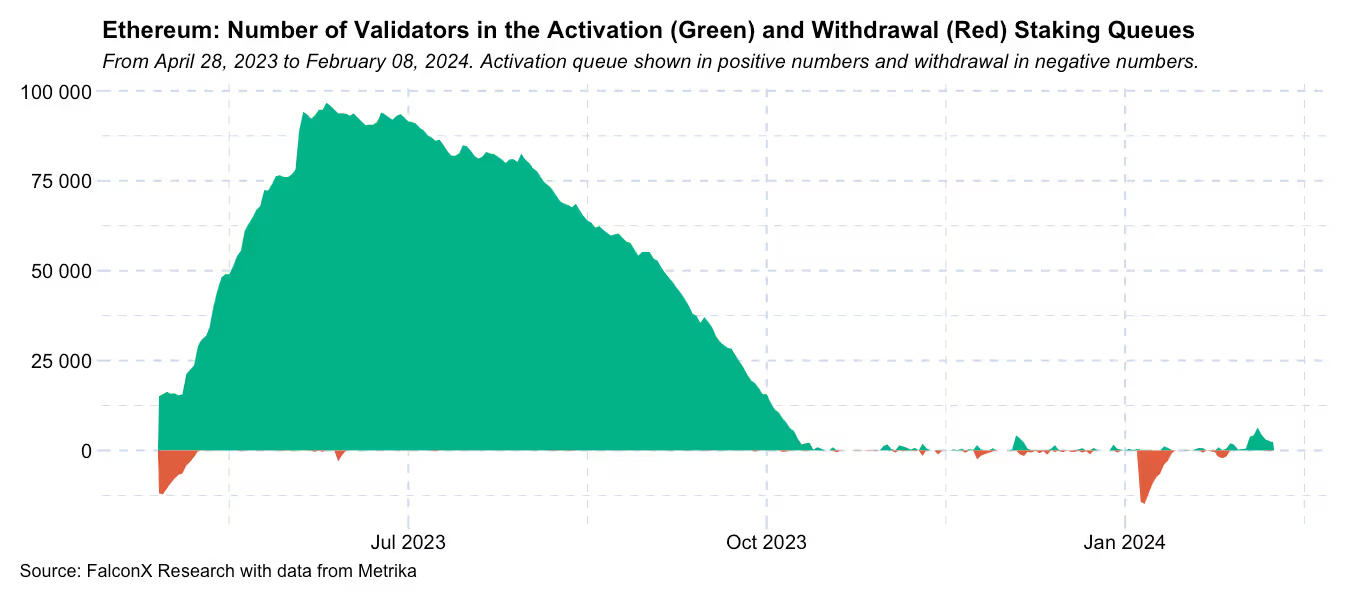

Resurgence in Ethereum Staking Activity Indicates Initial Signs of Renewed Vitality: Over the past week, the ETH staking activation queue has been the busiest since October 2023. The current levels are still a far cry from the tens-of-thousands-validators-long queue from the second and third quarters of 2023, but it’s a notable increase given that the Ethereum staking yield, as measured by the CESR, has not changed much so far this year.

The key driver everyone is watching is whether the potential ETH spot ETF will be allowed to stake. Ark/21Shares updated their S-1 form to include a staking component this week. The back and forth on S-1 amendments over the upcoming months ahead of the key date on May 23 will hint at whether that’s a real possibility.

Have a great weekend!

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.

.png)