Are We Entering a New Market Regime? The Growing Influence of Macro on Crypto Prices

The broader macro environment is quickly gaining prominence as a price action driver for risk assets more broadly and crypto in particular.

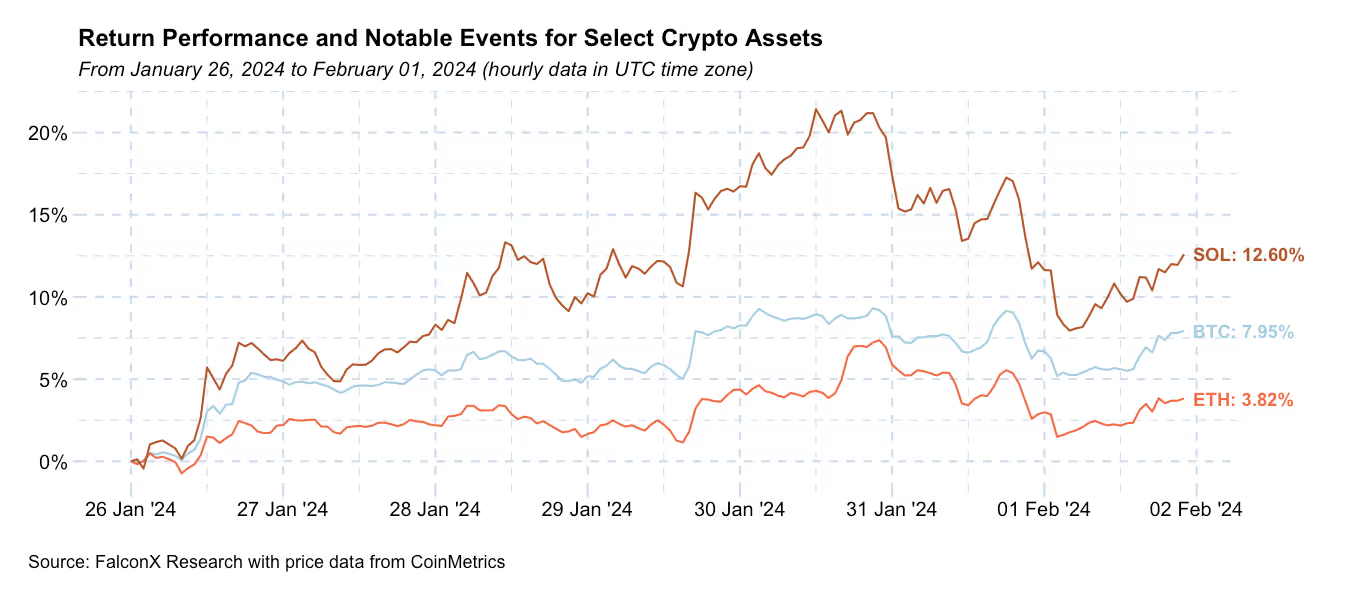

The total crypto market capitalization increased by 4.58% over the past seven days (or 4.88% excluding stablecoins) and currently sits at $1.59 trillion (or $1.45 trillion excluding stablecoins). Among the larger names, SOL continues to benefit from its bustling ecosystem. Just this week, we saw the successful Jupiter airdrop, one of the largest ever in the Solana ecosystem, and the introduction of token extensions, which extend the feature set of tokens on Solana to allow for new use cases.

As anticipated, one critical driver for the positive performance was the tailwind from the more positive spot BTC ETF inflow numbers. GBTC outflows remained at around $200 million per day, down from the previous $400-600 million range, while the other four major issuers are still bringing in sizeable inflows. This was enough to tilt total net inflows back to $100-200 million daily and $1.5 billion since launch.

The inflow numbers were particularly strong in the last days of January. Over the next few days, we’ll see whether they relate to the end of the month (when some allocators tend to concentrate portfolio changes) or whether these exceptionally strong inflows will remain in the next couple of weeks. At any rate, I remain confident that inflows will significantly outweigh these short-term outflows in the medium to long term.

The broader macro environment, on the other hand, is quickly gaining prominence as a price action driver for risk assets more broadly, and crypto in particular. It has been a while since we have seen meaningful intraday price movements stemming from shifting macro expectations.

This week likely marked the last Fed meeting in this cycle for which expectations were strongly anchored well in advance. Markets were quick to reprice expectations on a March cut after Jerome Powell indicated in his press conferences he sees a cut in the next FOMC meeting as unlikely: CME Fed Funds Futures now price these odds at only 20%, versus 46% a week ago and 70% a month ago.

Crypto followed suit: Right after Jerome Powell indicated in his press conference that he sees a March interest cut as unlikely, the BTC price fell over 4%.

As this report goes to press, the strong job numbers brought the 10-year yield back above the 4.0% level on expectations that strong activity data can push rate cuts beyond what some would expect also provoked an initial dip in crypto prices.

Although activity indicators remain exceptionally strong, uncertainty factors related to the Fed letting BTFP expire in March, potential renewed concerns around U.S. regional banks, the shrinking balance of the Fed’s reverse repo facility, and apparently increasing geopolitical tensions can also start to weigh in price actin over the next few months.

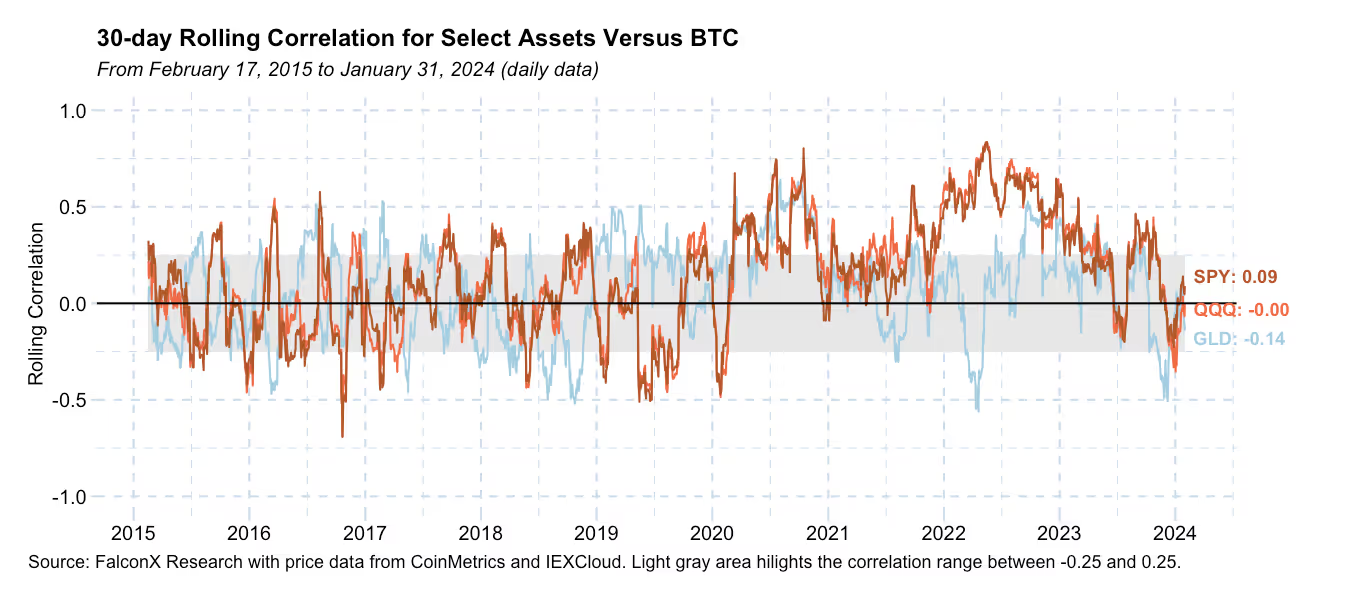

One chart I’ll be watching over the next few weeks and months is the one below.

It shows the correlation between BTC and broader risk assets, here proxied by SPY and QQQ. Traditionally, BTC has presented low correlations, but this situation changed throughout 2022 as market moved to a more binary risk-on/risk-off regime. Last year showed a notable reduction in correlations the the point of them reaching their lowest levels since before the COVID crisis.

Since the beginning of 2024, and especially over the past couple of weeks, the BTC/SPY correlation moved to slightly positive territory. I believe this number has room to go slightly higher over the next few months.

Other Top Trends We're Watching

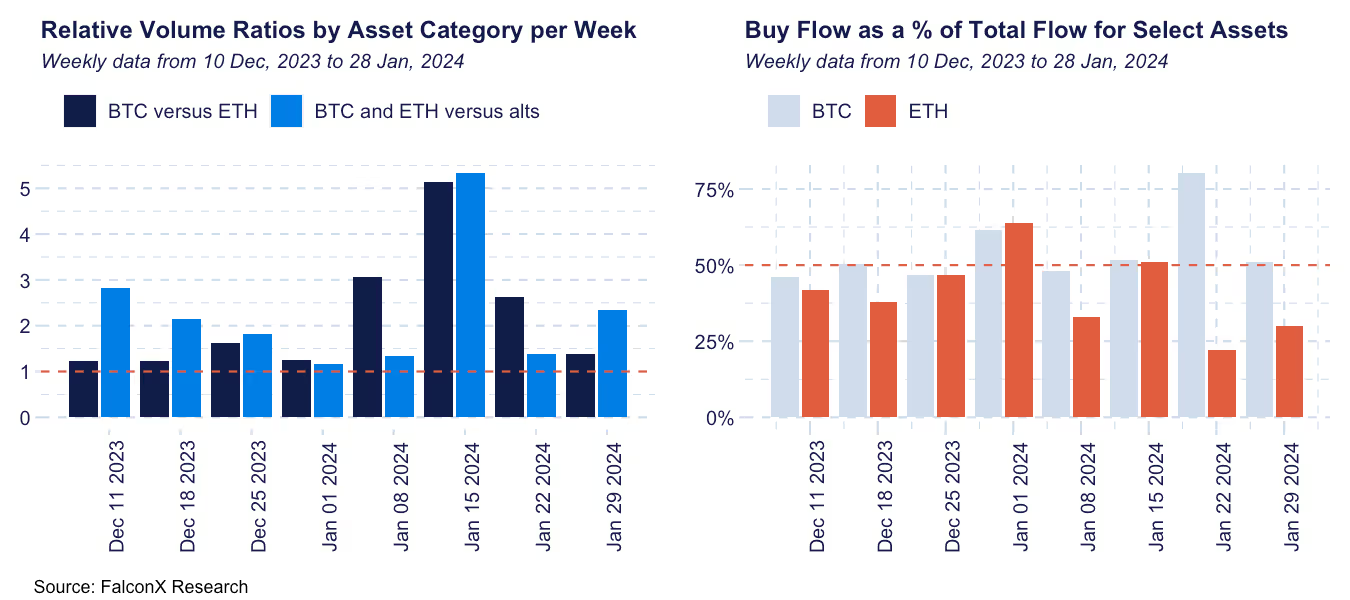

FalconX Trading Desk Color: Our desk saw flows in mixed directions across different client personas. For example, while prop desks and retail aggregators were mostly buyers, hedge and venture funds were more active on the sell side. Among majors, BTC crossed our desk 1.39x more than ETH, with 51.1% of the flow coming from the buy side (compared to only 30.0% for ETH). Our BTC buy/sell ratio has been higher than ETH’s every week but one since mid-October 2023. Among alts, SOL remains in a league of its own regarding investor interest (44% of the flow on the buy side). Other notable names include MATIC and LDO on the buy side and ARB and AVAX on the sell side.

ETF Fix Is Becoming an Increasingly Important Window for BTC Price Formation: One of the still under-discussed consequences of the recent spot ETF launches is how they can contribute to lowering the BTC volatility. One way that can already be observed in market activity is how the ETF fix concentrates a significantly larger share of the spot market trading volume.

By providing a transparent and consistent reference point recognized by increasing market participants, the ETF fix allows investors to aggregate large trades around a common time, reducing their market impact and overall market volatility.

The chart below shows the daily BTC trading volume percentage in the 30-minute buckets starting at 3:00 p.m. and 3:30 p.m. ET for the leading trading pairs. Activity from these two buckets, which regularly accounted for less than 5% of the total daily volume in aggregate, now represents 10-13%.

Our principal product manager Vivek Chauhan and I wrote more about this topic this week in this Coindesk opinion piece.

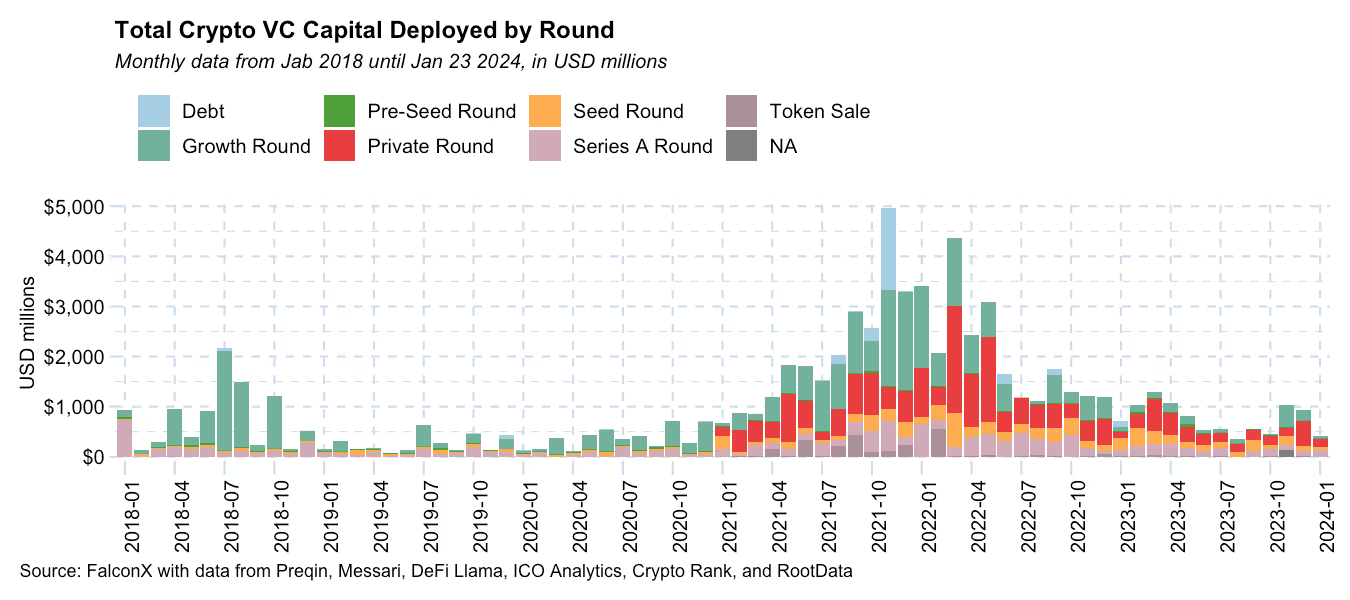

Will Crypto Venture Capital's Deployment Sustain the Positive Trend From Q4 2023? As we anticipated, the deployment pace of crypto venture capital funds posted a sequential increase in Q4 2023 for the first time in two years. According to estimates gathered by our market-making team, total VC investments surpassed $2.8 billion, growing 67.3% versus Q3 2023.

Preliminary crypto-deal activity data in 2024 (containing deals closed until January 23) show $406 million deployed so far. The amount is lower than the $714 million recorded in the same period last year, but it is still too early to draw any conclusions on how the quarter will look.

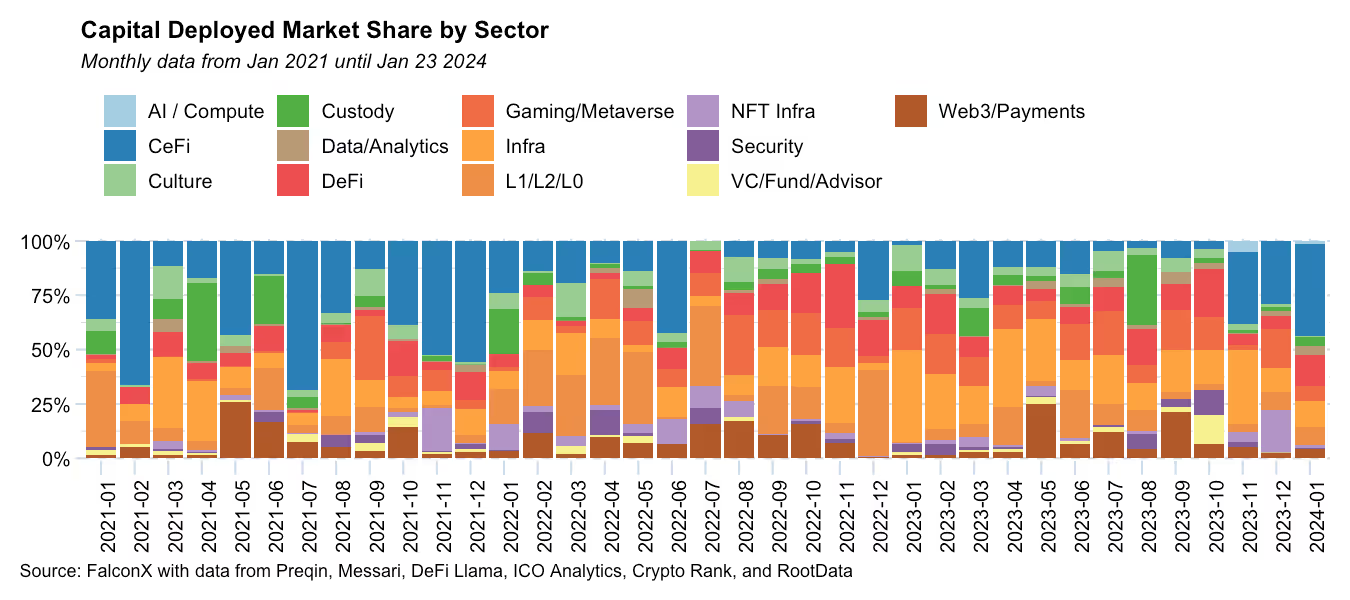

However, one trend that remains in place is the strong growth in deal activity related to centralized finance (CeFi) businesses. This vertical has been attracting the most venture capital investments since November. Hashkey, which achieved unicorn status after raising a $100-million series A round to fund its crypto exchange in Hong Kong, and Flowdesk, which raised $50 million in a series B to fund its liquidity provision activities, scored the two largest rounds so far at the beginning of the year.

Have a great weekend!

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.