Crypto Keeps Climbing as More Favorable Macro Takes the Driver’s Seat

The crypto market cap rose to $1.6 trillion with a notable shift towards altcoins like AVAX and ADA, which surged by 50% and 41.2%, respectively, buoyed by improved macro sentiment and anticipation of a spot BTC ETF approval. Despite a significant liquidation event earlier in the week, the market's underpinnings suggest we're entering a bull market with dynamics such as increased trading volumes and volatility, pointing to a promising outlook for 2024.

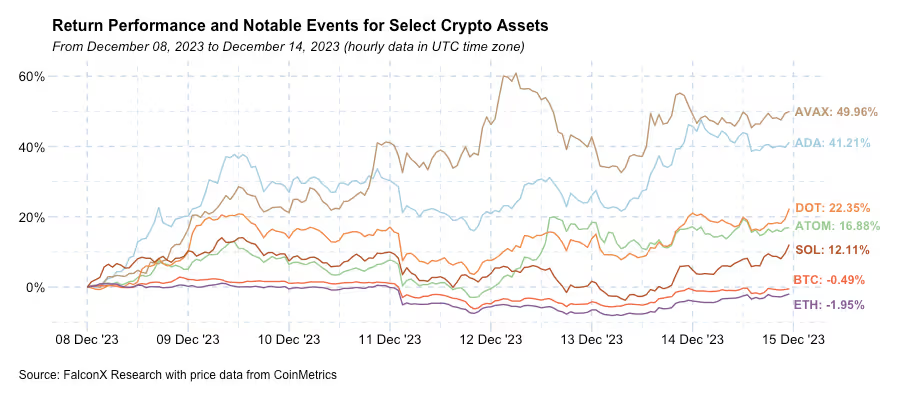

The total crypto market cap was up another 3.95% over the past seven days and now sits at $1.6 trillion. The week was marked by a strong rotation to alts, as BTC and ETH reported negative returns while several alt L1s were up double digits. This has been especially the case for some projects that have lagged: AVAX and ADA were up 50.0% and 41.2%, respectively.

The alts outperformance comes on the back of a more favorable macro sentiment supporting risk assets more broadly. This has been the case since late October, when the 10-year yield dropped from 5.0% to 4.1%. But the recent communication from the Fed has added further fuel, leading the 10-year to reach its lowest levels since August.

As we get into 2024, there’s much to be excited about in crypto between the more accommodative macro environment, the strong prospects of the spot BTC approval at the beginning of January, and developments in specific ecosystems.

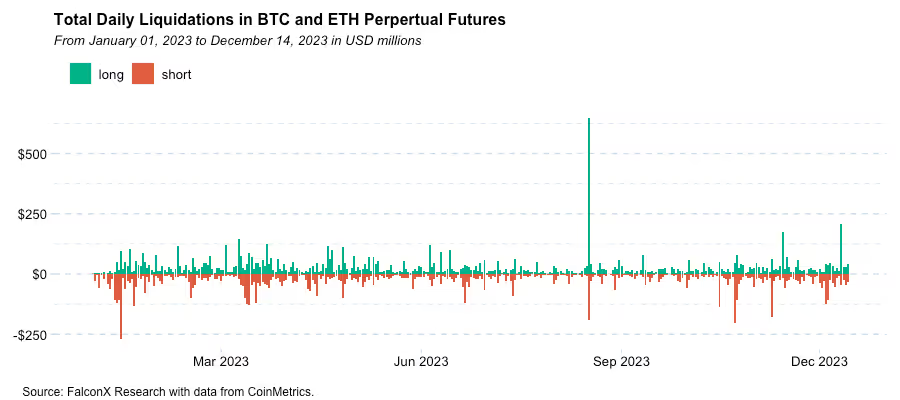

Gearing up to a bull market comes with different market dynamics, though. A great example was the liquidation in longs earlier in the week with a sharp market correction. At more than $200 million for only BTC and ETH, this was the second-largest long liquidation event of the year.

As high as this liquidation might look for 2023 standards, it’s tiny compared to the previous bull market. A $200 million long liquidation would not make it into the top 100 daily liquidations between 2020 and 2021. It would barely make it to the top 20 in 2022.

The changing market underpinnings that typically come with crypto bull markets are gradually becoming evident. Increasing spot trading volumes, more embedded leverage through derivatives markets, increased volatility, and now the more frequent and sizeable liquidations.

This combination will likely lead to the proverbial 20% + corrections that usually marked every single crypto bull market so far, but the outlook for 2024 looks promising.

Other Top Trends We’re Watching

FalconX Trading Desk Color: We saw strong activity last week, with hedge funds as better buyers and most other client personas as better sellers. BTC crossed our desks at 1.9x more than ETH as the leading crypto asset continues to drive investors' attention, but at a significantly lower magnitude than in October. Buy/sell ratios have been below 1x for the third week in a row for both BTC and ETH, but we have been seeing more bullish flows after the recent shift in macro sentiment driven by the Fed meeting on Wednesday. Majors traded 2.4x more than all alts, with a strong interest in names such as SOL, AVAX, APT, and MKR on the sell side and LDO, MATIC, and ARB on the buy side.

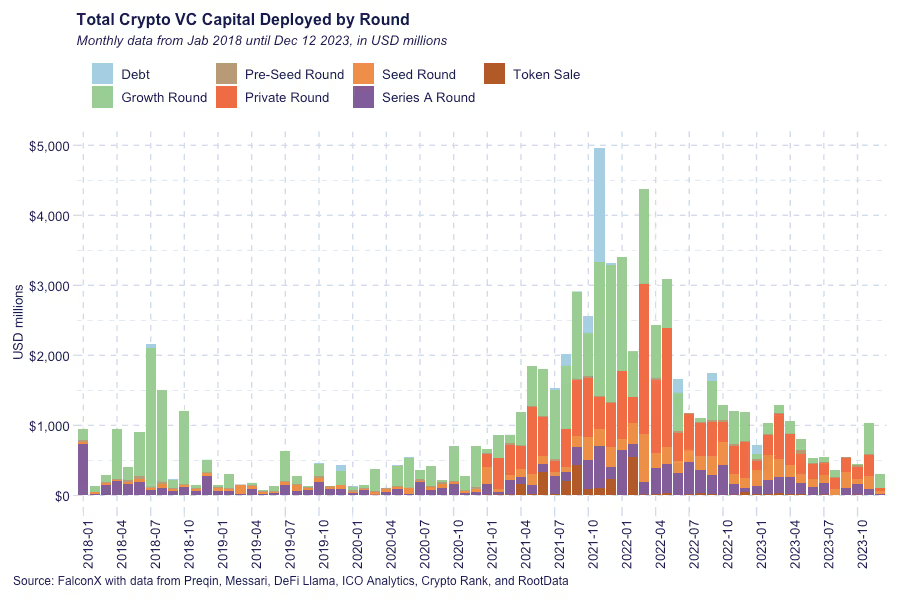

Crypto VC Capital Deployment to Show the First Sequential Increase in Seven Quarters: According to data collected by our market-making team, crypto VC investments ticked up significantly in November and are geared to show the first quarterly increase since Q4 2021. Deal data until December 12 already registers a total of $1.8 billion in Q4 2023, representing an increase of 23.9% QoQ.

Even though it’s too early to call for a trend reversal, as relatively few large deals bumped the Q4 2023 number, and the current level is still down over 50% on a YoY basis, it seems another indication that the crypto market is shifting gears.

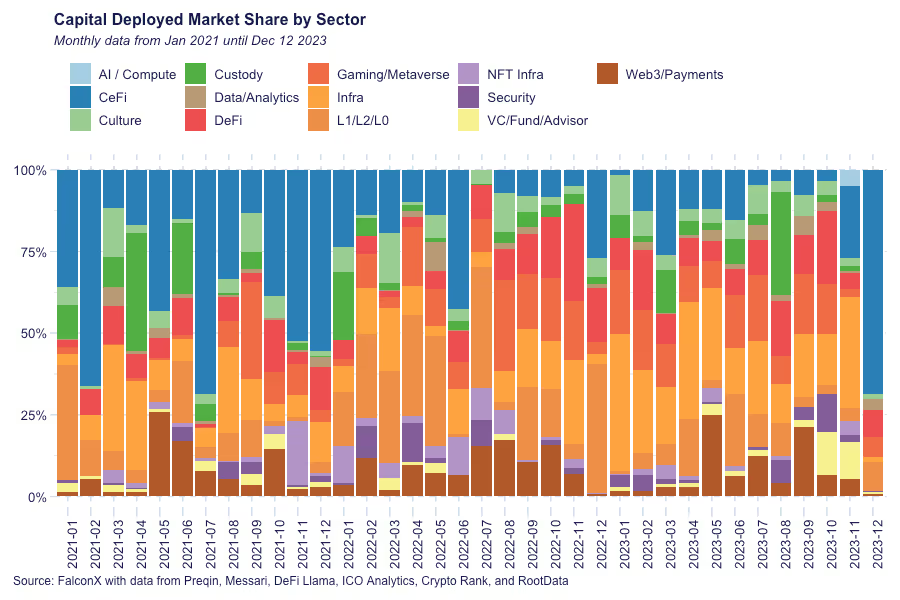

On top of the headline number, there have also been two interesting trend shifts. The first is the market share gain of growth rounds, which represented over 51% of the total amount raised in the quarter, versus 17-28% in the previous three quarters of the year.

The second is the increasing participation of deals in the CeFi and infrastructure sectors. This participation was driven by notable deals such as Wormhole (interoperability infrastructure, $225 million), Swan Bitcoin (Bitcoin-focused financial services provider, $165 million with $120 million to be deployed in private equity investments), Blockchain (exchange and wallet provider, $110 million), Fnality International (wholesale payments, $95 million), which together account for over 25% of the total amount raised by the industry in the quarter so far.

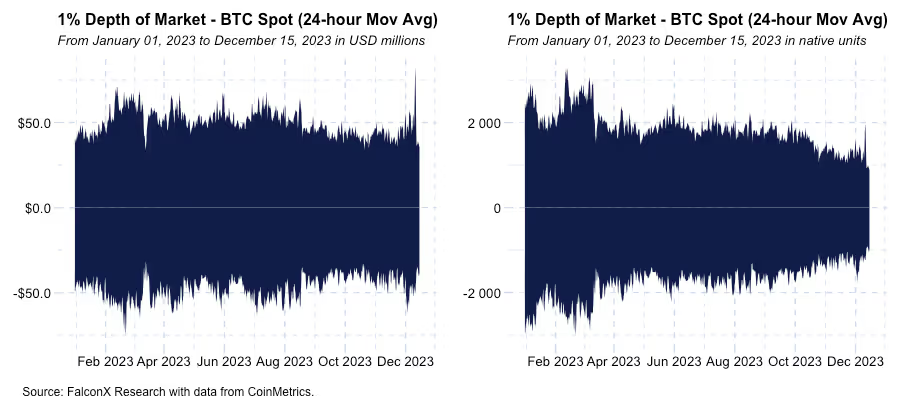

BTC Order Book Depth Suddenly Spikes During Correction But Resumes Downtrend: One of the defining trends of 2023 in the BTC market structure has been the consistent orderbook shrinkage (both in USD and native units). This has been an overlooked but important component of the rally, as higher trading volumes finding relatively thinner books translate into sharper price movements than they would otherwise.

As the chart below shows (1% book depth for BTC in USD on the left and native units on the right), BTC order books increased significantly during the correction earlier this week. I’m keeping a close eye on whether this means a reversal in the overall trend, but it’s looking like a temporary phenomenon so far.

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.