Crypto Markets Surge: Widespread Gains Beyond Majors BTC and ETH

Crypto keeps grinding higher, with BTC breaking above its previous cycle all-time highs two times this week. Interestingly, the rally is starting to spread more notably to non-BTC assets.

Crypto keeps grinding higher, with BTC breaking above its previous cycle all-time highs two times this week. The total crypto market capitalization was up 18.5% (or 19.6% excluding stablecoins) over the past seven days and currently stands at $2.48 trillion (or $2.33 trillion excluding stablecoins).

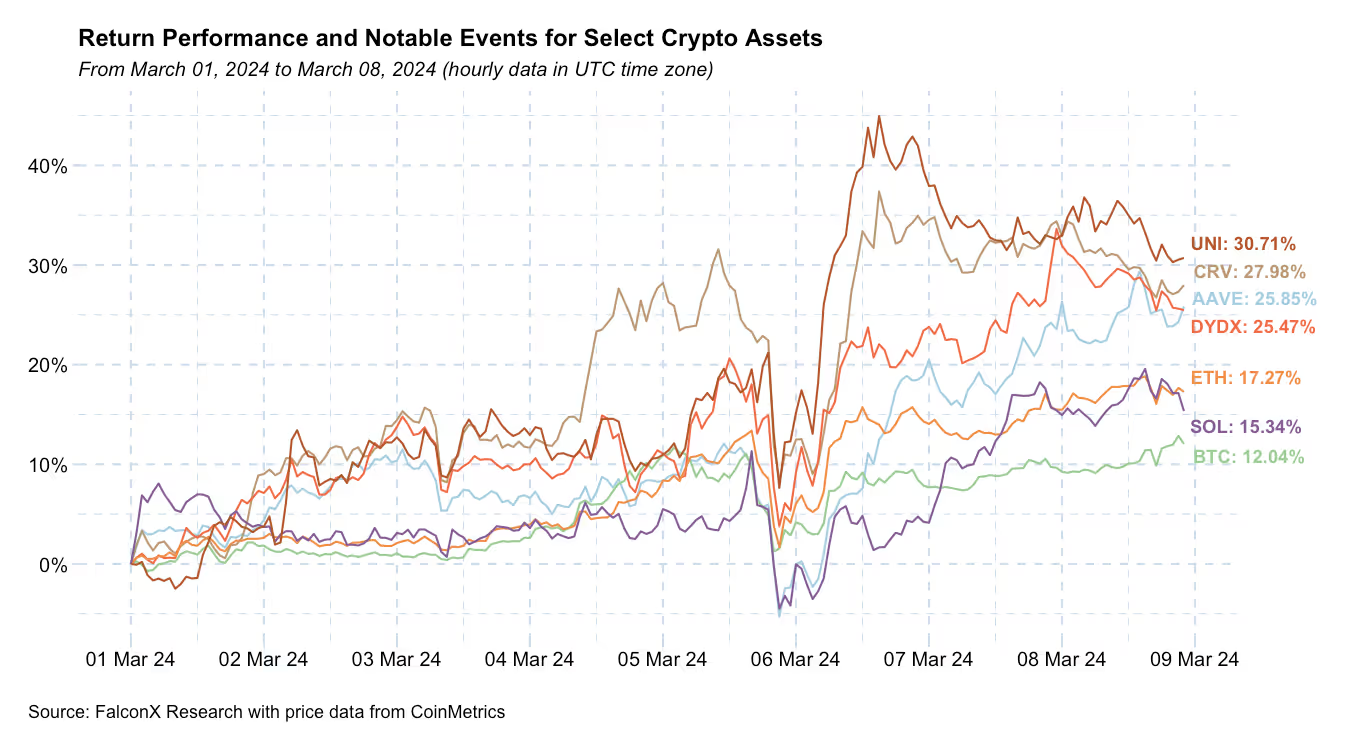

Interestingly, the rally is starting to spread more notably to non-BTC assets. As we anticipated a few weeks ago, ETH continues to outperform BTC (and even SOL) ahead of its upcoming Dencun upgrade on March 13. Mainstream DeFi assets such as UNI, CRV, AAVE, and DYDX also had a great week with returns above 20%. Perhaps more surprisingly at this stage in the cycle, memecoins SHIB and DOGE were the two best-performing assets among those with market caps above $5 billion.

As we highlighted previously, we are at the stage in the market cycle that crypto’s reflexivity tends to become more prominent. If until about one week ago spot ETF inflows were driving prices, I have the impression that more recently prices are, at least to some extent, starting to also drive inflows.

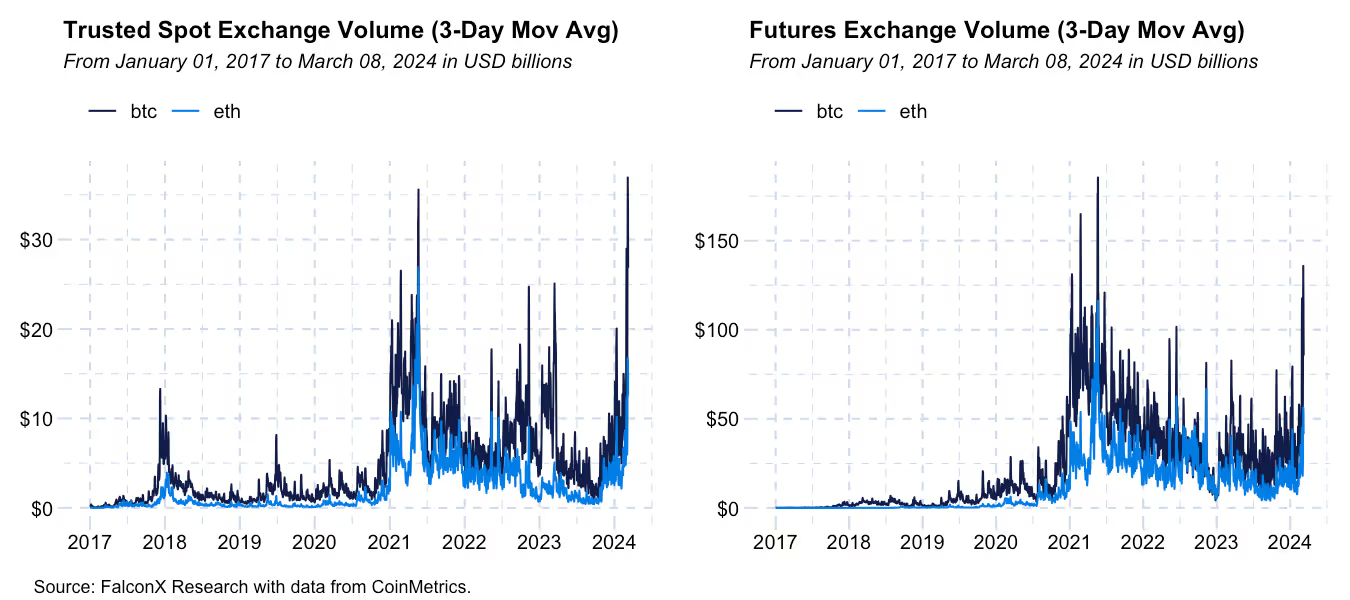

The liquidity trends underpinning the recent price action are supportive for prices. BTC just broke its all-time high spot volume under my favorite metric (CoinMetrics trusted spot exchange volume, 3-day moving average) at almost $37 billion. Futures daily volumes are also already printing in the top 10.

If the past cycle is any guide, we might hover around the current levels for a while before decisively breaking into a new inning of the bull market trend. All market signals so far indicate that the current bull market trend remains in place.

Other Top Trends We're Watching

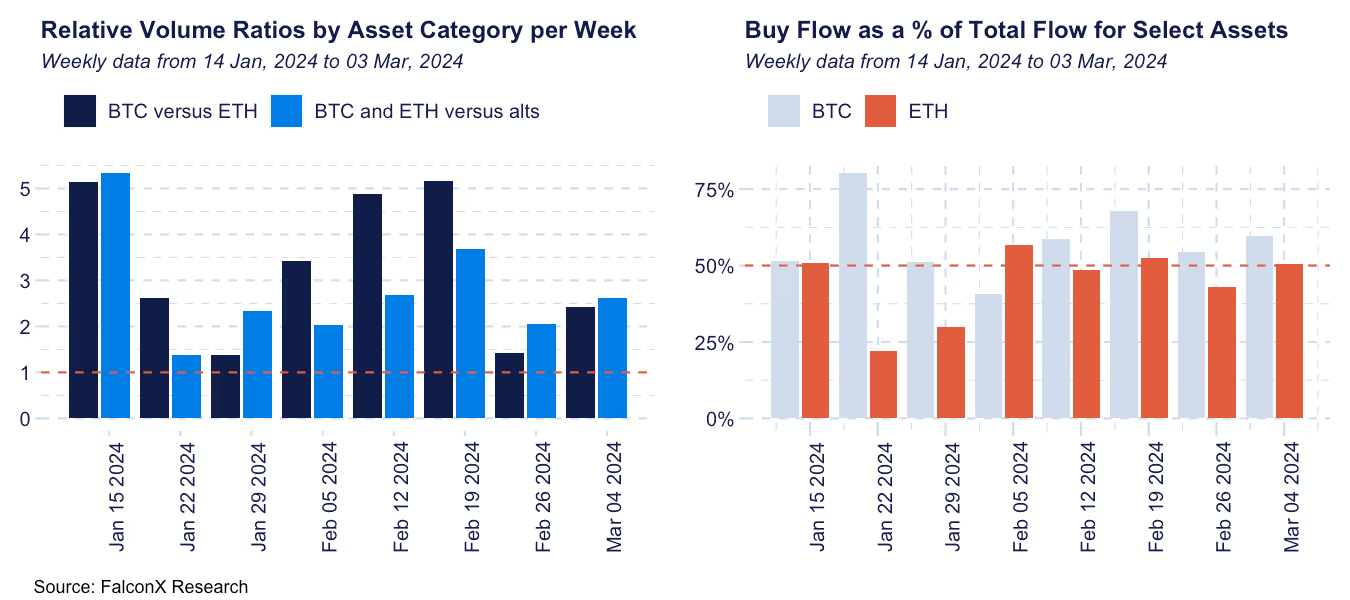

FalconX Trading Desk Color: The trends at our trading desk have mostly stayed the same. BTC continues to dominate flows, while ETH continues to gather attention, and interest in alts spreads to more names. Most client personas were better buyers, but we saw some sell flow coming from retail aggregators and venture capital funds. Our BTC/ETH volume ratio remains elevated at over 2x on the back of ETF flows but less than it has been recently. Buy/Sell ratios remain above 1x for BTC due to strong ETF inflows and continue to trend upwards for ETH over the past six weeks. Among alts, we saw primarily buying interest in names such as SOL, DOGE, and AVAX and selling interest in MKR, SHIB, and AR.

Key Takeways from ETH Denver: One of the high-signal conferences in the U.S. crypto conference circut took place last week in Denver. Due to the number of simultaneous presentations and side events it’s not possible to have all-encompassing view of all the topics and topics discussed, but in my view most discussions were centered around the themes below.

Bitcoin layer two solutions was probably the most surprising trend to some, with Bitcoin Renaissance standing out as one of the most well-attended side events. The recent development of BitVM makes possible the development of L2s solutions on top of BTC that are more, although not completely, similar to what exists in the Ethereum ecosystem. There are already probably more than 20 Bitcoin L2 projects given how large the potential target market is (The general thought is that if the ETH L2 ecosystem is ~$50 billion in mkt cap, BTC’s could be worth at least this in 3-5 years).

As expected, EigenLayer and the ecosystem around it continues to attract an immense amount of attention. The introduction of a new use-case for ETH, the provision of security to other chains, catapulted EigenLayer to the second spot in the Ethereum TVL ranking and is translating into a rich ecosystem of LRTs and AVL operators. Although these are extremely exciting times, some highlight the potential risks involved (mostly related to introducing additional counterparty risk).

The upcoming activation of Dencun (March 13) will introduce a native data availability (DA) layer on Ethereum. This development, coupled with other alternative DA layers (such as Celestia, Avail, and EigenLayer DA), naturally brought a lot of attention to this part of the blockchain stack.

More broadly, there have been many discussions around the two types of blockchain architecture: Modular (i.e., separating the consensus, data availability, and execution layers) versus Monolithic (one blockchain doing all these three functions). On the extreme of the modular spectrum, Celestia is the best representative. In contrast, on the opposite end, there’s Solana, with more established blockchains such as Bitcoin and Ethereum somewhere in between.

Interoperability re-emerging as a key theme. One critical challenge with the Myriad Ethereum layer two solutions is the fragmentation of liquidity and how to build reliable yet decentralized communication networks between them. Layer Zero, one of the largest and best-funded projects in the space, will likely drop their token in June/July. Together with EigenLayer, Layer Zero will likely be one of the year's most prominent token launches and is already attracting attention to this space. This likely explains with other interoperability-related tokens such as AXL is performing well recently.

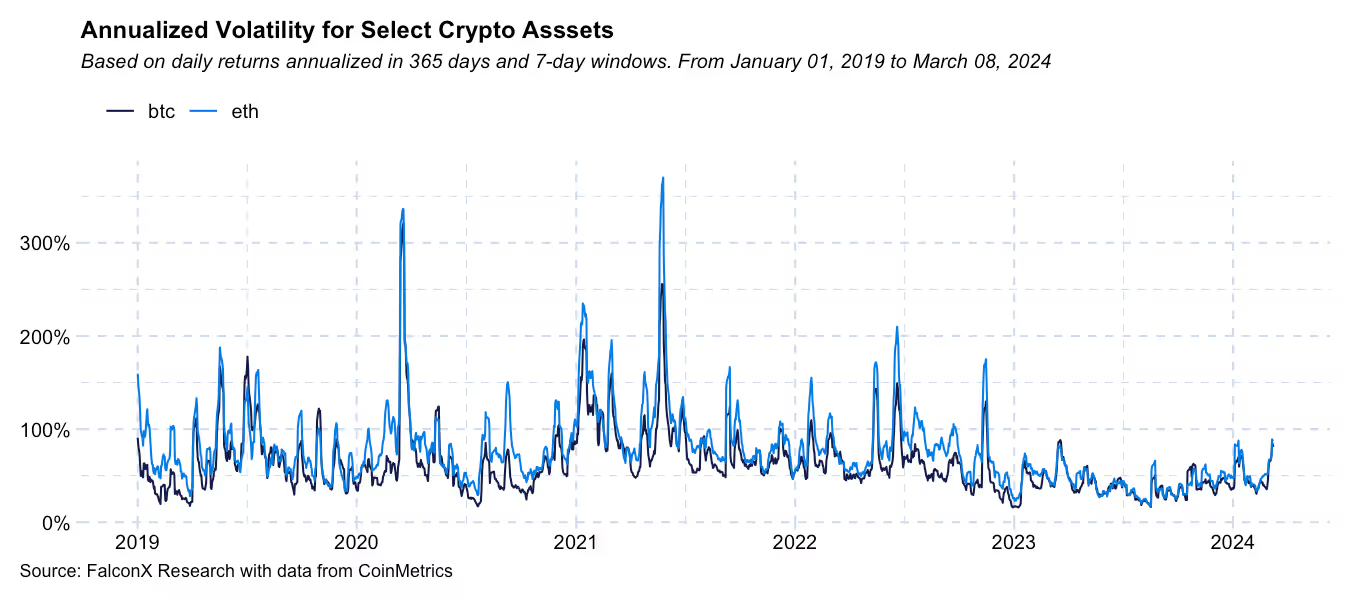

Color From our Options Desk: Volatility levels in the cryptocurrency market have been notably high, with Bitcoin's Daily Volatility (DVOL) hitting a 16-month intraday peak recently. Last week, our clients predominantly sought volatility, especially for longer-dated options. However, this week has seen a shift with some unwinding in-the-money call positions, contributing to a reduced market vega. A significant vol selling program was observed on Deribit during the highest volatility levels. This suggests that if the spot market continues to decline, we might see a further correlation that could help lower volatility.

Selling put spreads is an option for investors looking to take advantage of these conditions while maintaining a bullish stance. This strategy benefits from the current elevated volatility levels, as evidenced by the increase in 30-day straddle breakevens by approximately 4% since last Friday.

At the same time, yield-generation strategies are gaining attention among market-neutral funds due to the recent surge in volatility and forward basis. The yield on 1-month 25% out-of-the-money covered calls has soared to over 30% annualized, reaching multi-year highs.

For those holding long positions in the spot market, employing covered call strategies can effectively generate yield and reduce delta exposure at advantageous spot levels. Alternatively, selling Put spreads can serve as a yield-generating approach while expressing a bullish outlook on the market.

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.