Choppy Crypto Market Amid Increased Geopolitical Tensions and Macro Uncertainty

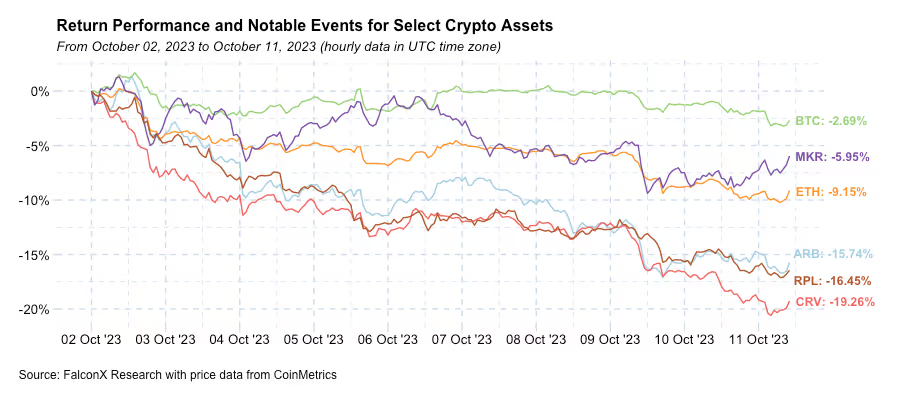

Crypto remains choppy, as its total crypto market capitalization was down 1.79% (or 2.05% excluding stablecoins) over the past seven days and currently stands at $1.04 trillion (or $917 billion excluding stablecoins).

BTC was the best performer across all major assets. Volumes remain low, and volatility subdued, even if slightly higher than the multi-year lows seen in mid-August. BTC renewed the lowest spot daily volume print of the year last week, but activity in ETH is slightly recovering versus the previous week. The 30-day annualized volatility for BTC and ETH currently stands at 27.7% and 36.0%, respectively, at the lowest 6 and 3 percentiles.

Our thoughts are with those affected by the horrifying terrorist attacks in Israel.

For crypto and risk assets more generally, Noelle Acheson put it well: The uptick in global tensions makes another interest rate hike this year much less likely, but the flurry of Fed officials suggesting no more hikes from here is likely coming on the back of the higher bond yields and their possible impact. CME Fed Funds Futures are now pricing an 84% chance of no change in the next FOMC meeting on November 1 versus 59% a month ago and 77% a week ago.

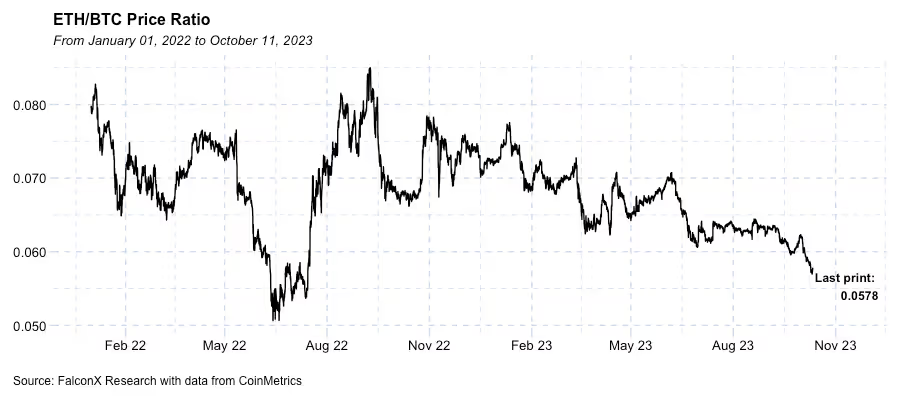

I continue to pay attention to the ETH/BTC price ratio, which renewed its lows in 2023 to levels previously seen 14 months ago. In my view, the trigger for further BTC outperformance was mainly the uncertain macro and geopolitical environment increasing interest in alternative monetary assets, as highlighted by Paul Tudor Jones in an interview yesterday.

Another potential reason for the recent ETH underperformance was the relatively cold receptivity of the recently approved futures-based ETFs, which raised only about $17 million in aggregate across six funds since last Monday. Even if these products were not expected to raise significant capital, and their importance is likely more as an intermediary step until a potential spot ETH ETF launch later down the road, the volumes were somewhat underwhelming in our view.

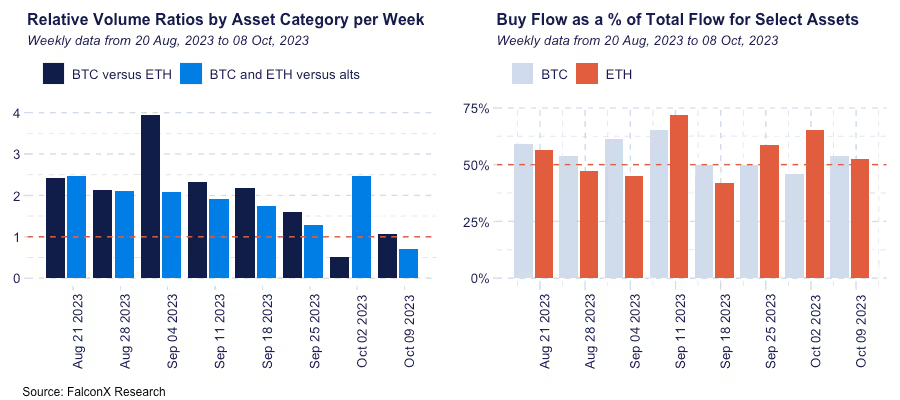

Top Three Trends We're Watching

FalconX Trading Desk Color: Our desk activity saw flows coming mostly from the buy-side for specific investor personas (hedge funds and retail aggregators) and the sell-side for others (prop desks and venture funds). Majors BTC and ETH crossed our desks at about the same volume, as we saw a relative increase in BTC volume versus last week, in which ETH traded 2x more than BTC for the first time in the previous eight months. Overall, our BTC flow tilted more bullish (54% of our flow came from the buy side, versus 46% in the last week), while our ETH flow leaned more bearish (53% of total flow from the buy side, versus 67% in the week prior). All alts combined traded only 0.7x of our volume in the majors, the lowest ratio in the past eight weeks. Buy/sell ratios among alts varied widely, with names such as MKR and LDO strongly seeing buying pressure and others such as OP and ARB on the other side.

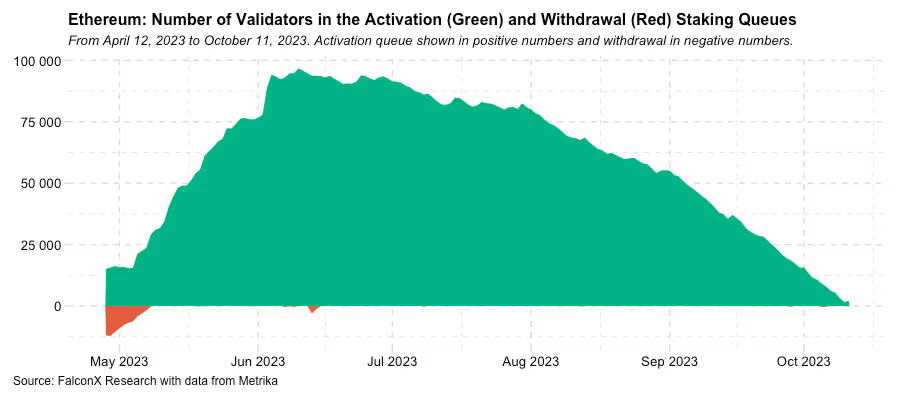

Eth Staking Activation Queue Continues to Dwindle and Is Now Almost Empty: The number of validators waiting to stake ETH, an indicator we have been following for a couple of weeks now, has shrunk from almost 100,000 in June to only slightly more than 2,000 currently. The chart below shows the size of the activation (green) and exit (red) queues since the Shapella upgrade in April.

An empty activation queue implies a slowdown in the growth of staked ETH, which has been exceptionally strong since the Merge and Shapella upgrades, if the trend remains. While currently sitting at 22.2% of the total supply, the Ethereum staking participation rate lags behind some of their peers (Solana 69.3%, Cardano 63.3%, Avalanche 57.4%) chiefly because ETH is more used as a network resource and has a more distributed shareholder base.

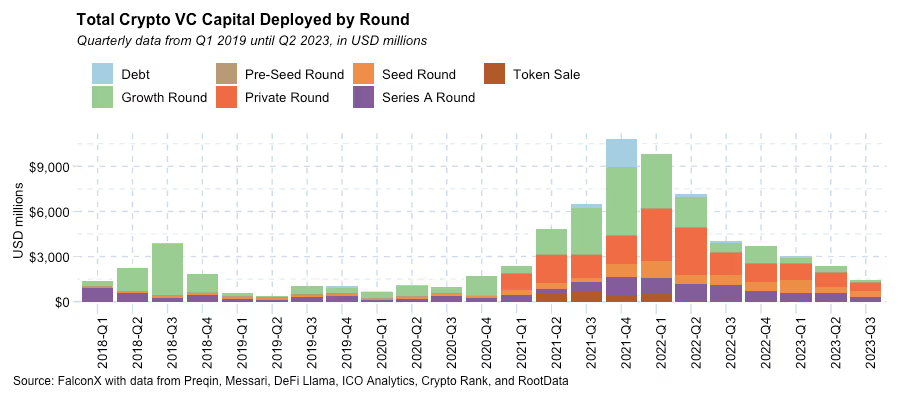

Crypto Venture Investing Reach a 3-Year Low: According to data compiled by our market-making team, capital deployment in the crypto industry shrinks sequentially to $1.4 billion in the third quarter of 2023, the lowest value since the third quarter of 2020.

Overall, the major trends that have been in place throughout the year, as highlighted in our recent dedicated report on the subject, remain unchained: The mix of crypto venture investments remains more tilted to earlier-stage (especially seed) than to growth-stage (series B and later deals).

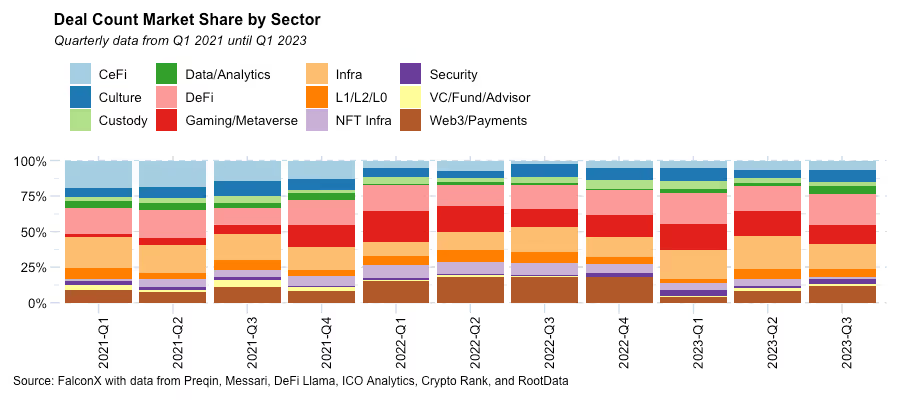

From a sector market share perspective, the sleeves that increased their participation included custody (on the back of the $100 million series C raise by BitGo), decentralized finance (mainly due to raises from Brine.Fi, Alluvial, Helio Protocol, among others), and gaming/metaverse (with notable raises from FutureVerse and Proof of Play). On the other hand, the participation of infrastructure and L1/L2s shrunk as large deals such as the ones by LayerZero and Sei from Q2 did not repeat in Q3.

The good news of the third quarter is that crypto venture funds started launching new funds. For example, Blockchain Capital announced $580 million in new capital across two funds in September, while CoinFund and Polychain raised another fresh $158 million and $200 million in July, respectively. We expect to continue to see more such announcements between now and the end of the year.

Have a great week!

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.

.png)