BTC's First Touch at $100k and Legacy Altcoin Revival: Unpacking Two Current Key Market Themes

BTC briefly broke above the important psychological level of $100k for the first time yesterday, supported by Paul Atkins' SEC chair nomination, a move welcomed by many in the crypto industry, and Jerome Powell's comments at the New York Times DealBook Summit, where he framed BTC as a gold competitor rather than a dollar challenger.

However, a quick correction ensued and took us back to five-digit price territory. Given the current setup of the underlying liquidity trends, the hard grapple at the $100k threshold should be expected. The correction's intensity was notable, as nearly $400 million in BTC perpetual long liquidations triggered a brief dip below $90k on one exchange before stabilizing just under $100k.

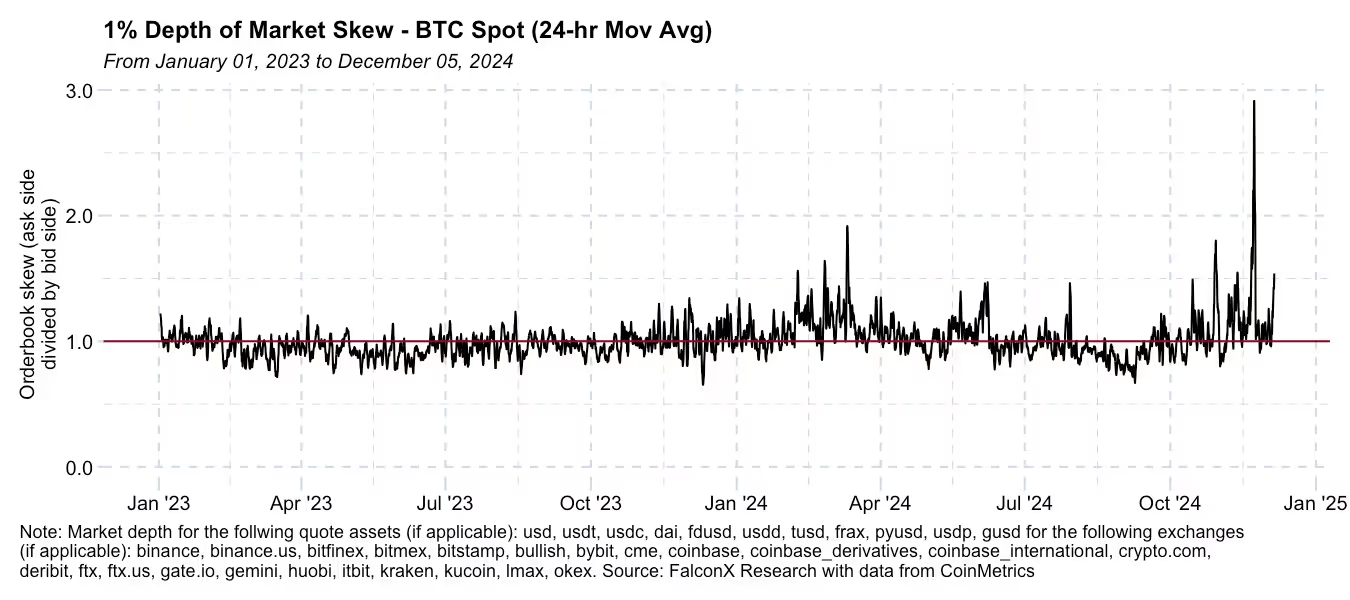

The BTC spot order book skew (ask side divided by bid side) remains tilted towards the sell side. In other words, the executed buy orders were not replaced by new buy flow, which may set up the market for short but quick corrections.

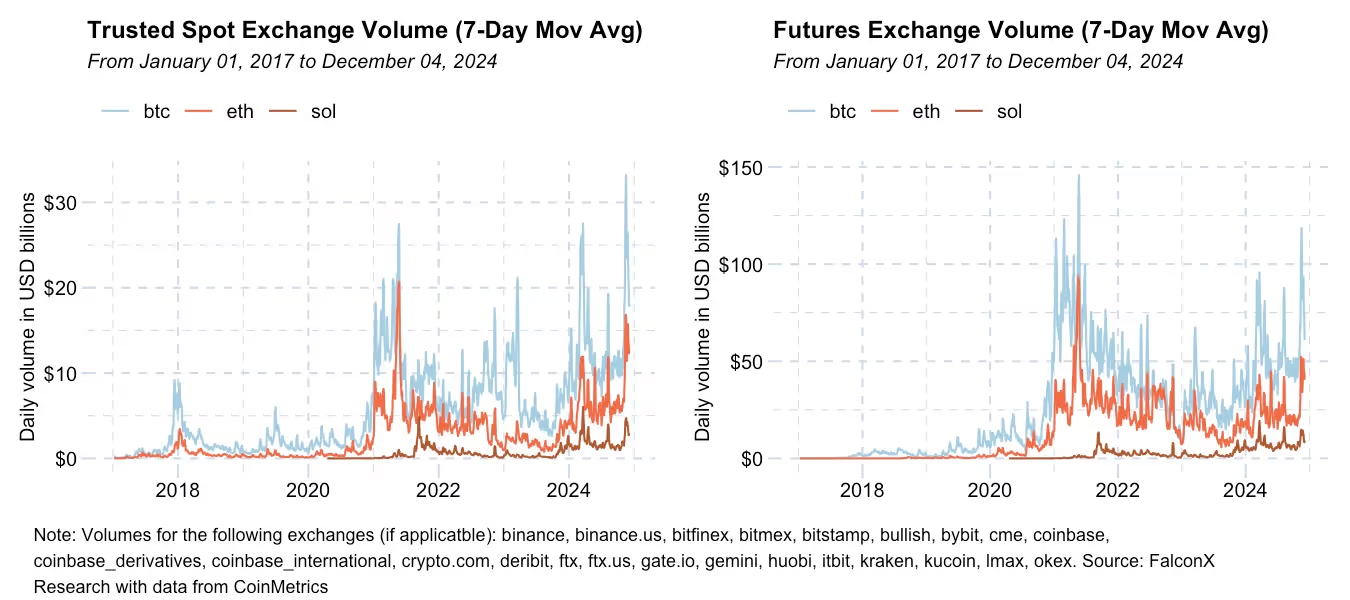

BTC's break above $100k also occurred on relatively modest turnover. Yesterday's spot volume of $26 billion, while high compared to historical levels, falls short of November's post-election levels when volumes consistently exceeded $30 billion and occasionally brushed $50 billion.

The broader market environment remains exceptionally constructive. Since November 6, BTC spot ETF net inflows totaled a whopping $8.8 billion. This is good reason to believe that a chain of positive news flow related to a more friendly policy and regulatory environment could start hitting the tape over the coming months.

On top of this, BTC's 30-day correlation with major equity indices has nearly halved over the past four months, highlighting the growing importance of crypto-specific catalysts.

That said, liquidity trends suggest that while improved expectations drove us near $100k, a sustained and decided push past this level may require some of these positive catalysts to materialize.

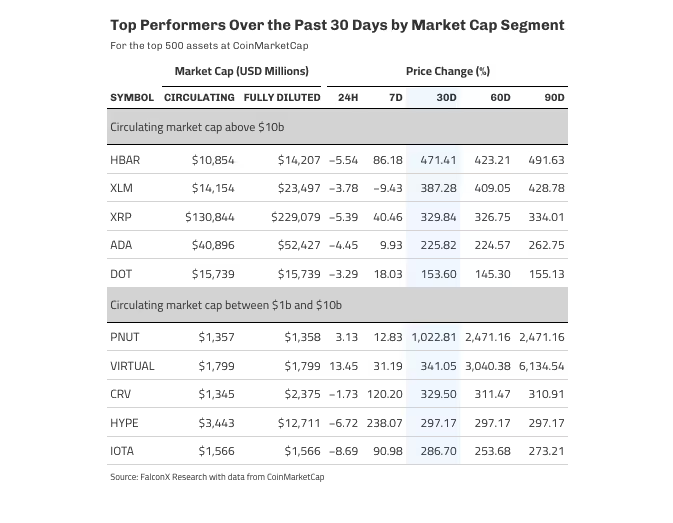

Another notable, and perhaps even more surprising, theme is the surge in legacy alt assets. The table below ranks the top five assets by 30-day performance across market cap segments. Among the assets with a circulating market cap of more than $10 billion, legacy alts dominate (HBAR, XLM, XRP, ADA, and DOT).

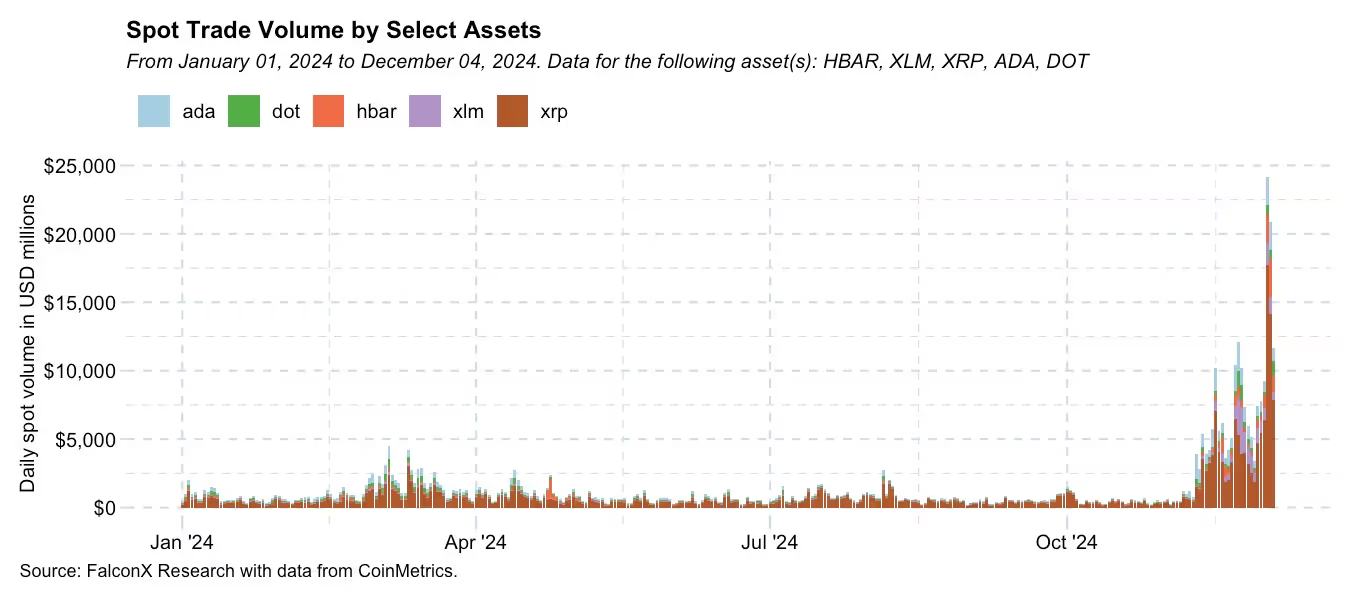

Combined spot volumes for the larger legacy tokens (HBAR, XLM, XRP, ADA, and DOT) rarely hit $3 billion in 2024 pre-election, but now consistently range between $10-25 billion. While XRP dominates this volume, the chart below shows the volume surge extends to the historically less liquid tokens as well.

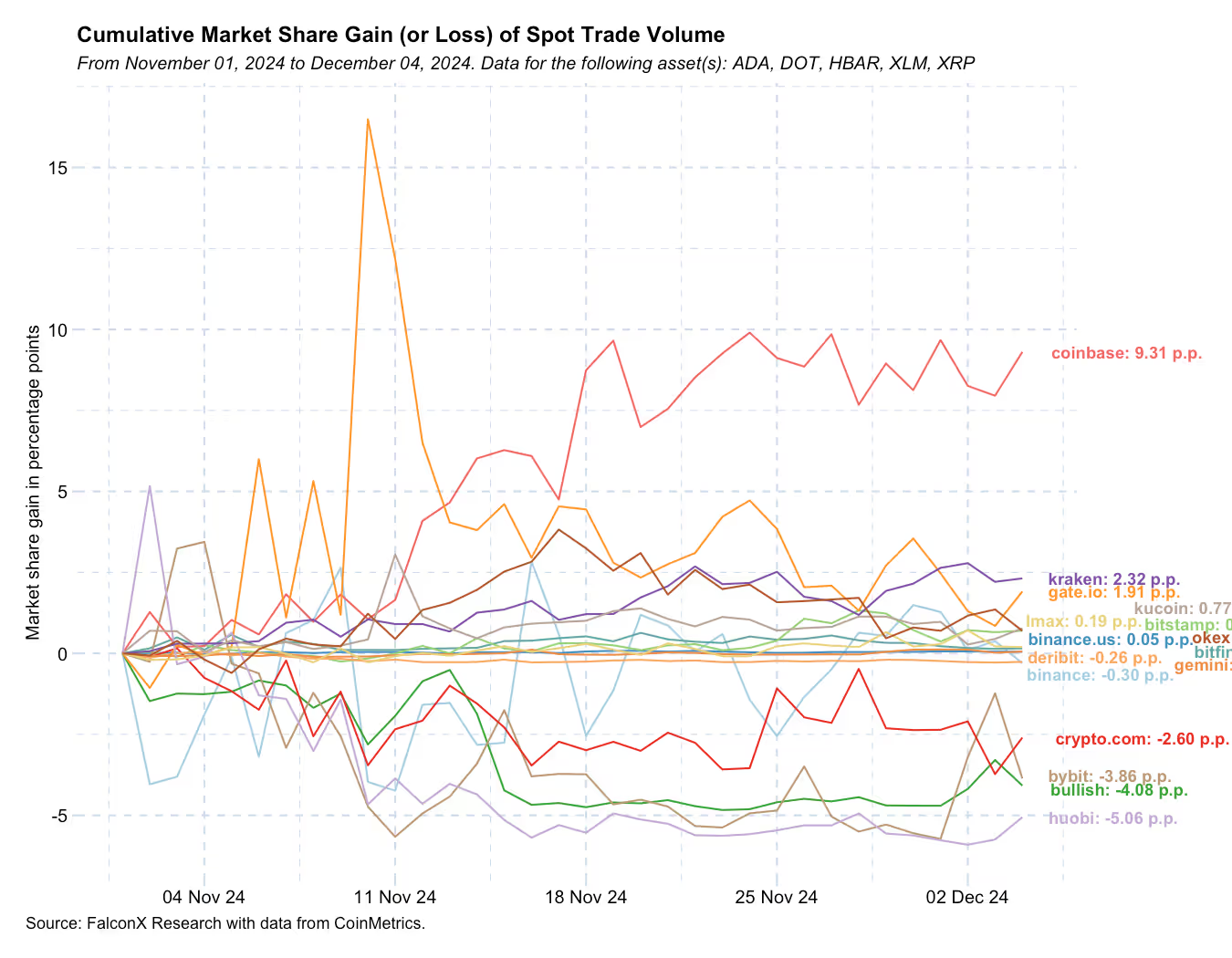

The exchange spot volume market share breakdown suggests strong participation from US/European retail traders. As the chart below shows, Coinbase gained over nine percentage points in spot market share among these tokens since the beginning of November, while Kraken added another two, mainly at the expense of Huobi, Bullish, and Bybit.

Our desk flows confirm this trend.

Volume in these five legacy tokens surged over 70% in the past week compared to the prior period, with roughly half coming from retail aggregators. But unlike our BTC flow, where buy orders outpaced sells by over 70% at our desk, these tokens saw more balanced two-way flow.

Flow dynamics could shift a bit, however if these trends remain as we get closer to the month-end rebalancing process of crypto index funds. Given their substantial market caps, XRP and ADA in particular could gain increased portfolio weightings, potentially attracting more institutional capital to these names.

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.

.png)